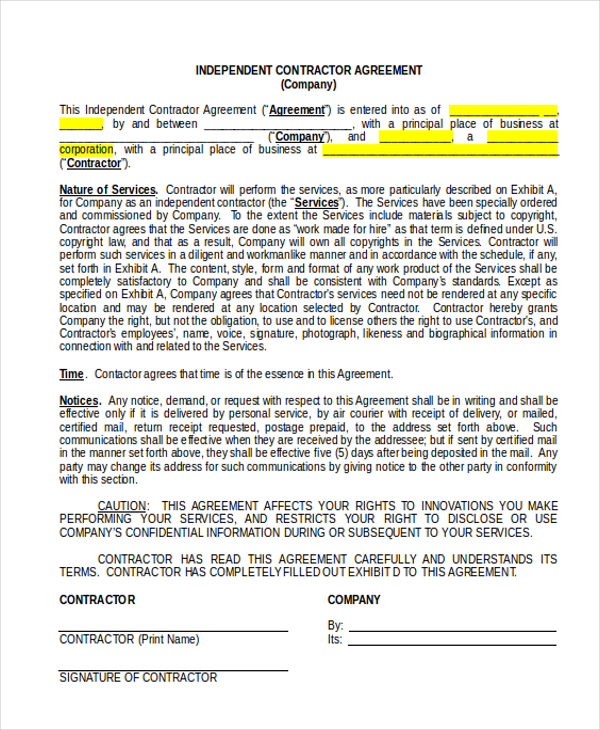

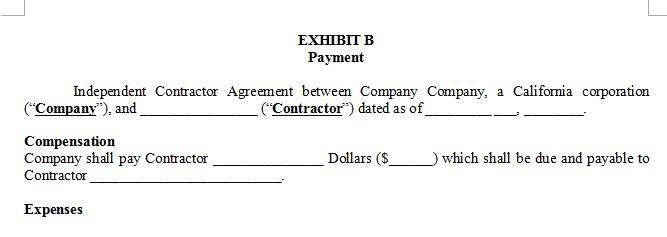

And withholdings, and Company shall file an IRS Form 1099 reflecting all contractual payments paid by Company to Contractor under this Agreement Contractor and Company further agree that 1 Contractor has the right to perform services for others during the term of this AgreementContractor represents and warrants to Company that (a) Contractor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company; Agreement for Independent (IRS Form 1099) Contracting Services _____________________, referred to as CONTRACTING PARTY, and ___________________, referred to as INDEPENDENT CONTRACTOR, agree INDEPENDENT CONTRACTOR shall perform the following services for CONTRACTING PARTY

Free 10 Sample Independent Contractor Agreement Forms In Ms Word Pdf Excel

Independent contractor agreement sample pdf

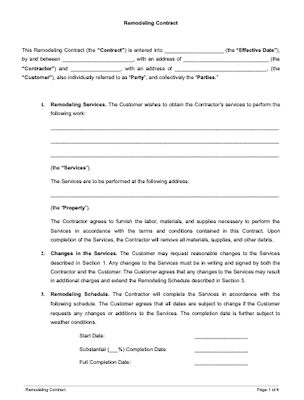

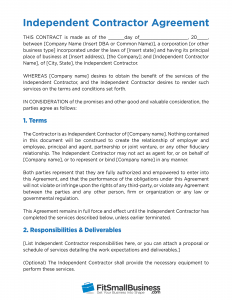

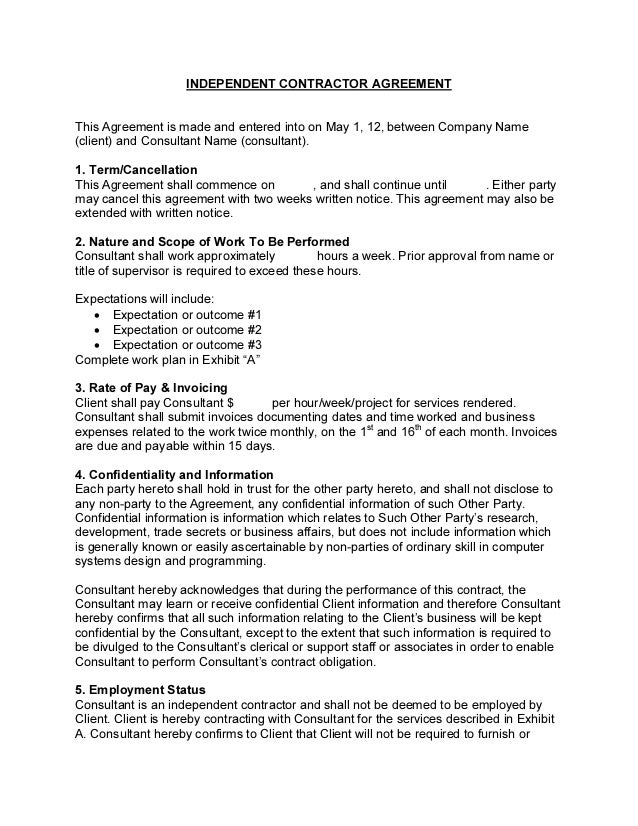

Independent contractor agreement sample pdf-A business owner needs an Independent Contractor Agreement for several reasons Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itselfIt is a clearcut explanation of the expected workflow, how communication will be handled, and howProfessional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter "COMPANY"), and _____, having an address of

Simple Independent Contractor Agreement Form Template

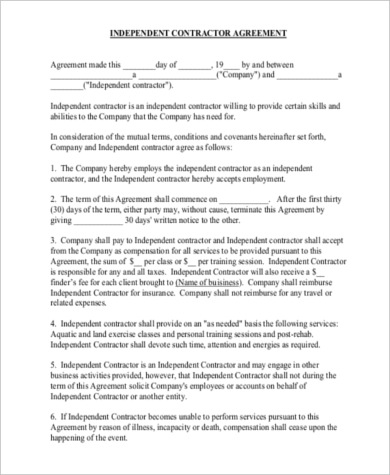

A truck driver independent contractor agreement is a document that legally binds a contractor and their client to a working arrangement Generally speaking, truck drivers are hired to transport goods from one facility to another or from a seller to a buyer A clear description of the tasks that the contractor is required to fulfill must be provided in the work agreementThe independent contractor nondisclosure agreementis intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosure agreement in place, the contractor(b) Contractor will not violate the terms of any agreement with any third party;

Between CRNA and CRNA Contractor Termlength of contract Availability Noncompete clause Independent contractor status Independent Contractor 1099 Control is the key Compensation Is there a minimum?For permanent employment positions, check our formal job offer letter format and informal offer letter templates Dear Candidate_name,Our hiring team was excited to meet and get to know you over the past few eg days/weeksIt is my pleasure to offer you a position at Company_name in the role of Job_titleThis a fixedterm position that will start on start date and end on end date1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and _____("Contractor"), Federal Identification (or Social Security) _____

An independent contractor agreement is a document that clarifies the terms of a job for which a company An independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a An independent contractor is a selfemployed individual who provides services to an employer working independently under a contractual agreement If you are thinking of hiring an independent contractor, understand key elements of the contract that should be covered so your company isn't liable for unanticipated taxes and other legal problemsContractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood that the Representative is solely responsible for the payment of all taxes on commissions paid by the Company under this Agreement

Simple Independent Contractor Agreement Form Template

Independent Contractor Agreement Form 53 Simple Joint Venture Agreement Templates Pdf Doc A Templatelab Answer A Few Simple Questions

Sample 1 Independent Contractor Indemnification It is understood and agreed, and it is the intention of the parties hereto, that during the Term, Brill shall be an independent contractor, and not the employee, agent, joint venturer or partner of the Company for any purpose whatsoever Nothing contained in this Agreement shall be construed toRelated Agreements Babysitting Agreement – To be used for a babysitter write the house rules, compensation, and any other details for watching another's children Nanny Contract – For a nanny that is to take care of a child on a recurring basis and commonly involves Let's have an insight of 25 1099 deductions for independent contractors which you may not aware of Now identify and track qualified business expenses and creates easy reporting for tax filing If you have to break a rental agreement and have to pay any fees, those fees are partially deductible as well Example $8,500 casualty/theft

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Agreement Pdf Word

Independent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9 Obligations of Independent Contractor – Independent Contractor acknowledges and agrees√99以上 sample 1099 contractor agreement Sample independent contractor agreement An Independent Contractor Agreement, also known as a consulting agreement or freelance contract Describes the services being provided or project to be completed Outlines payment details and the length, or term of the contract Sets out other terms of theSample independent contractor agreements are available online Using an independent contractor agreement template will save you time over creating an agreement from scratch The 1099NEC is needed to report how much income an independent contractor earns in a year

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template For 21 Bonsai

free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreement template pdf an independent contractor agreement also known as a '1099 agreementAgreement at the rate provided by Contractor services pursuant to this Agreement II Independent Contractor A Determination of the Manner and Means to Perform the Services; 1099 Contractor 50/50 split Same $96,000 1099 gets $48,000 You get $48,000$19,0 (% for expenses) = $28,800 But, your expenses will not go up much, renting her/him space will be the same, so post $28,800 you may only have 10% in expenses

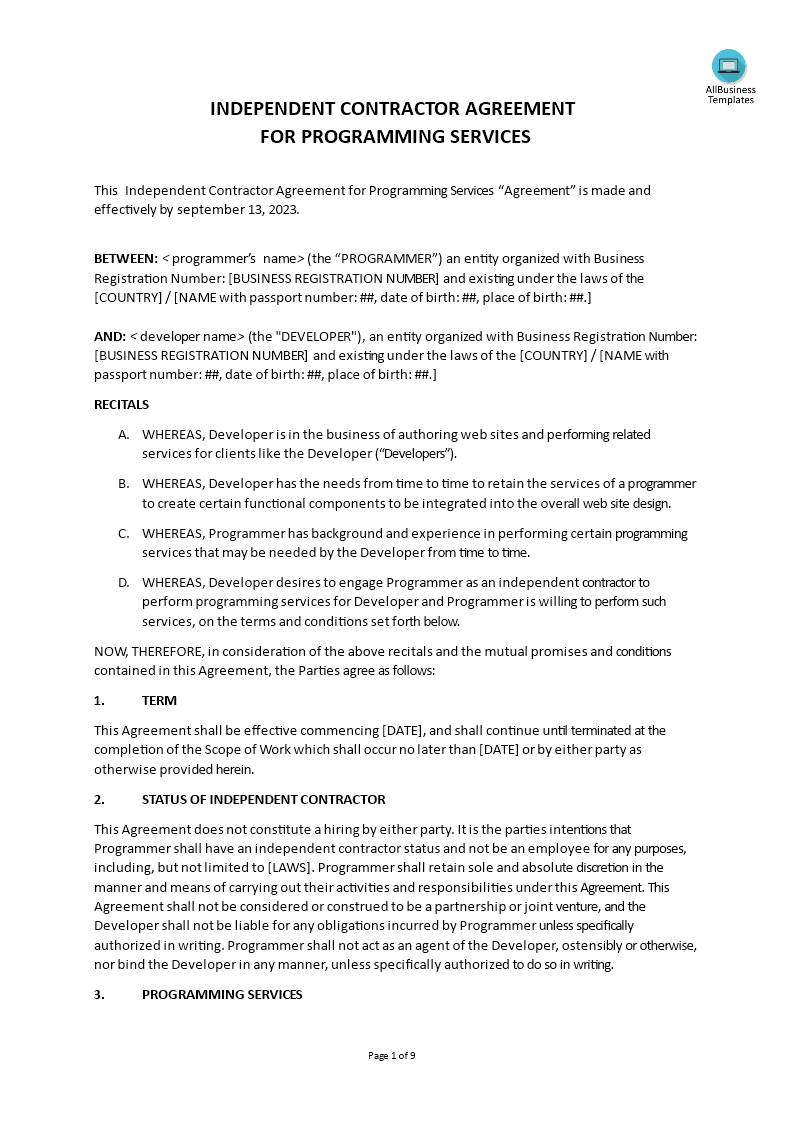

Independent Contractor Agreement For Programming Services Template Sample Best Word Pdf Download

3

Because an intelligent question at that point would have been for a lease agreement, not a 1099 employee contract I love it when people say I had an audit and it was okay, so it is legal Majority of all IRS audits already have a target in the office when the audit is startedAn Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including A description of the services provided Terms and length of the project or service Payment details (including deposits, retainers, and other billing details)CONTRACTOR will never solicit (while this Independent Contractor Agreement is and accounts receivable, and provide CONTRACTOR with 1099 tax forms c) Dispatching The COMPANY will maintain a telephone answering and appointment setting service for the INDEPENDENT CONTRACTOR

Independent Contractor Agreement Template By Business In A Box

Canada Independent Contractor Agreement Template Legal Forms And Business Templates Megadox Com

Exhibit 1011 INDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT (this "Agreement") is made and entered into as of (the "Effective Date"), by and between FVA Ventures, Inc, a California corporation ("ViSalus"), and Dr Michael Seidman ("Contractor")Each of ViSalus and Contractor are sometimes referred to individually What are Independent 1099 Sales Representatives?And (c) the Services and

The Ceo Legal Loft Shop Small Business Legal Resource

Independent Contractor Agreement Template Approveme Free Contract Templates

Both Client and Independent Contractor represent and warrant that each Party has full power, authority and right to execute and deliver this Agreement, has full power and authority to perform its obligations under this Agreement, and has taken all necessary action to authorize the execution and delivery of this AgreementOf this Agreement Client wishes to retain Contractor for such services on the basis set out in this Agreement 1 Services and Fees 11 Services Contractor will perform services ("Services") for Client as described in the Scope of Work ("SOW") attached as Exhibit A 12 FeesContractor is licensed to practice medicine at the time of this Agreement or in which the Independent Contractor becomes licensed to practice during the term of this Agreement Upon request by Principal, Independent Contractor shall provide a copy of the CME certificate to the Principal or its designee

Letter Of Appointment For Independent Contractor Templates At Allbusinesstemplates Com

Independent Contractor Agreement Full Time

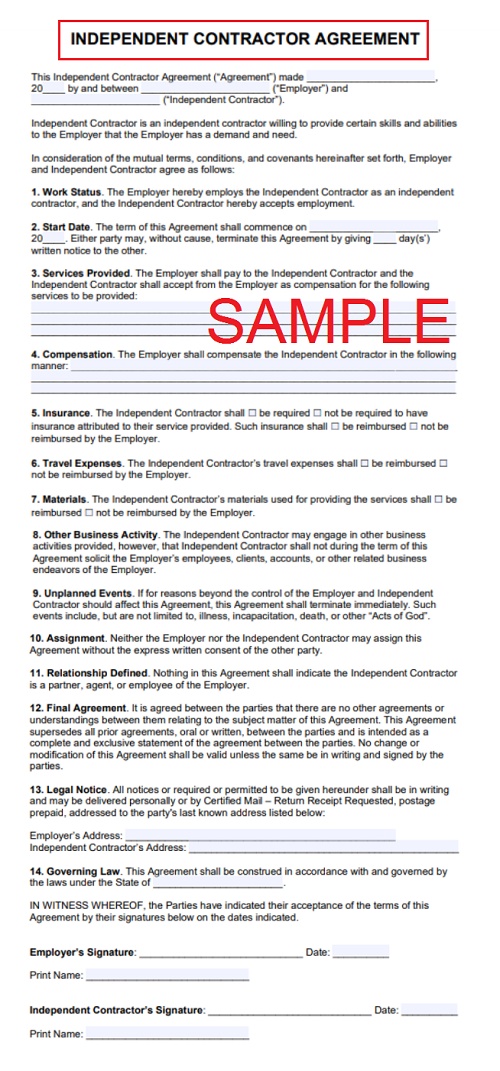

1099 Independent Contractor – A caregiver is commonly paid as an independent contractor and not an employee;Contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 Services Provided The Employer shall pay to the Independent Contractor and theThat in performing under the Agreement;

Independent Contractor Agreement Template Word Pdf Download Tracktime24

Free Independent Contractor Agreement Template Download Wise

Independent Contractor Agreement Form Template with Sample Free Independent Contractor Agreement Form Download Business Form Template Gallery 5 1099 Employee Contract Template Oiupt 1099 Employee Agreement form Employee Contract for 1099 1099 Employee Contract Template Independent ContractorSUBCONTRACTOR AGREEMENT THIS AGREEMENT made this ___ day of Month, Year, by and between CSA CONSTRUCTION, INC, a Texas corporation whose principal address is 2314 McAllister Road, Houston, Texas , hereinafter called "Contractor" and Subcontractor, a company whose principal address is _____, hereinafter called "Subcontractor" Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Modele Professionnel

As well as your own health benefits, medical expenses, life insurance, and retirement fund CONTRACTOR also acknowledges that CONTRACTORStart your own Contractor Agreement here on LawDistrict now and follow our simple stepbystep instructions to set up a personalized final document Sign the agreement In the last step of this process the completed Independent Contractor Agreement needs to be signed by both parties to make it legally binding It's not a legal obligation to have the document signing witnessed,1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;

Independent Contractor Agreement For Programming Services Template By Business In A Box

Independent Contractor Agreement Template Easy Legal Templates

Settlement for Unbiased (IRS Shape 1099) Contracting Products and services _____, known as CONTRACTING PARTY, and _____, known as INDEPENDENT CONTRACTOR, agree Click on right here for PDF model Because the tempo of Executive downsizing continues to extend, terminations for comfort–cancellations of contracts by means of the Executive just because its wishes alternate and without reference to contractorContractor acknowledges that it will be necessary for Client to disclose certain confidential and proprietary information to Contractor in order for Contractor to perform duties under this Agreement Contractor acknowledges that disclosure to a third party or misuse of this proprietary or confidential information would irreparably harm ClientThis agreement Contractor and the Practice shall be named as additional insureds in this subsequent policy as well Before the first day that Independent Contractor is scheduled to see patients, he shall provide Contractor with a copy of said insurance policy and a copy of his North Carolina licensure certificate

1099 Form Independent Contractor Free

Contractor Agreement Template 23 Free Word Pdf Apple Pages Document Download Free Premium Templates

The Contractor acknowledges and agrees that the Contractor is an independent contractor and not an agent or employee of the Company The Contractor warrants that it will perform the services set forth in this Agreement consistent with the Company's Policy for Independent ContractorsA legal contractor is someone who does the following Controls when and how customers are seen Pays expenses without getting reimbursed Contract with company states they're an independent contractor There are certain rules the IRS sets that sales representatives must follow They are considered employees if they Agreement for Independent (IRS Form 1099) Contracting Services _____________________, referred to as CONTRACTING PARTY, and ___________________, referred to as INDEPENDENT CONTRACTOR, agree INDEPENDENT CONTRACTOR shall perform the following services for CONTRACTING PARTY

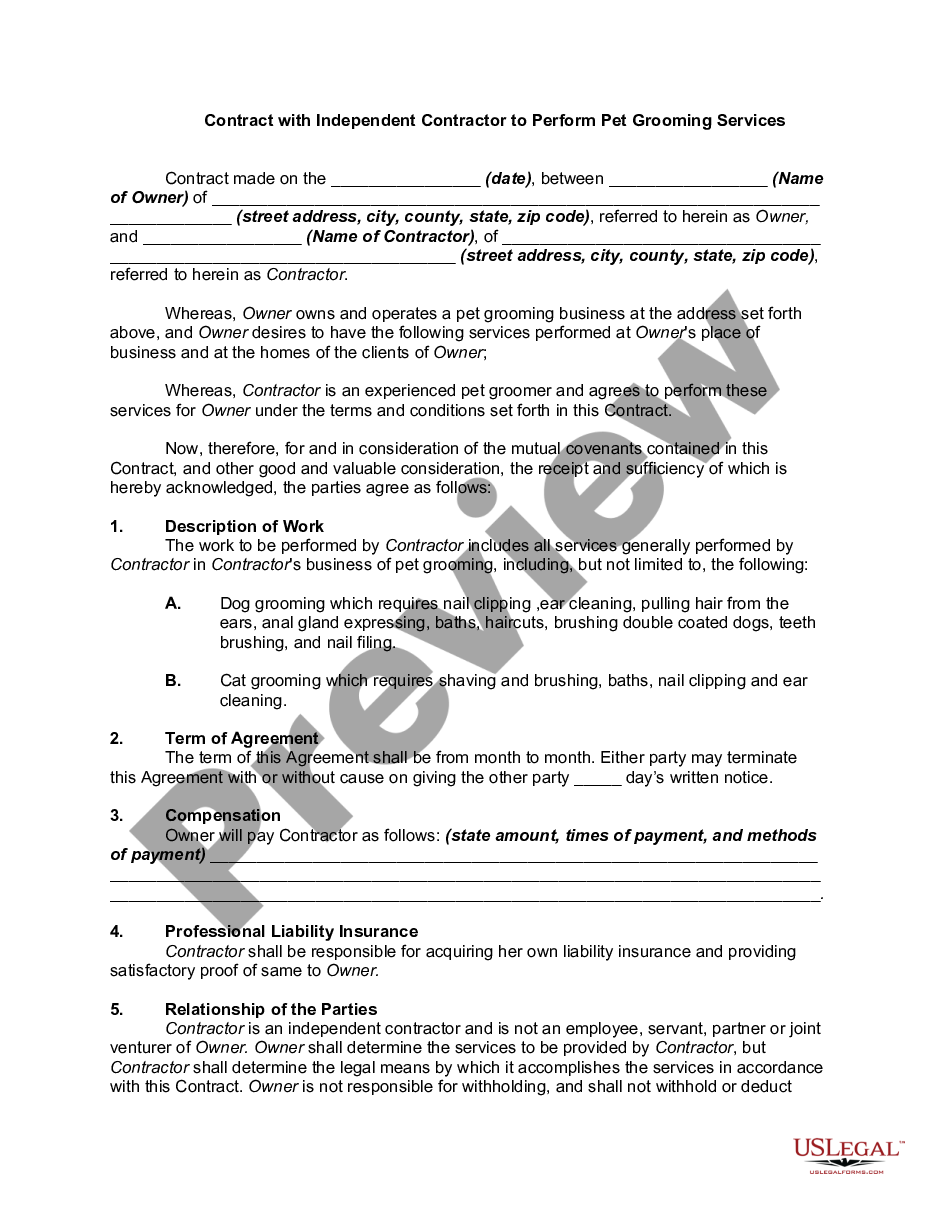

Contract With Independent Contractor To Perform Pet Grooming Services Pet Groomer Independent Contractor Agreement Us Legal Forms

Uk Independent Contractor Agreement Form Legal Forms And Business Templates Megadox Com

Order and Sequence of Work Contractor shall have the sole right and responsibility to determine the manner, method, and means of performance Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these Contract examples for 1099 drivers Discussion in ' BCS contended that the agreement between Boudreaux and Scout established that Ryes was an independent contractor of Boudreaux only, and that Ryes could not at the same time be an independent contractor of Scout I have found that can support those that have 1099 contractors

50 Free Independent Contractor Agreement Forms Templates

1099 Form Independent Contractor Agreement

INDEPENDENT CONTRACTOR AGREEMENT SALES AGENT This Agreement entered into on the ____ day of _____, ___, between Doctor Backup, LLC (hereinafter referred to as "the Company") and _____ (hereinafter referred to as "the Agent") shall remain in effect from this date until terminated by either partyTime Commitment Right to set your own compensation Sample forms Sample contracts Courses CE approval pendingGet The Complete Presentation https//landingpageswebsiteleadpagesnet/agilitypresentationtophrissuesof14/Call (619) For More Information

Freelance Trainer Agreement Template Employee

Independent Contractor Agreement Agreement For Consulting Services

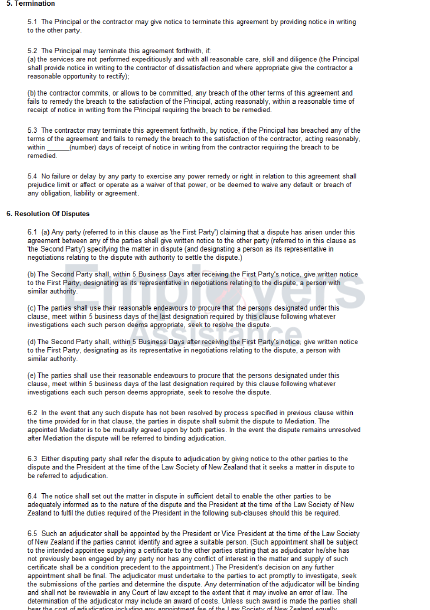

It may be terminated by the Corporation with cause – defined as (1) the failure of the Contractor to act in furtherance of the interests of the Corporation and its clients, (2) a material violation by the Contractor of any provision of this Agreement, (3) the conviction of the Contractor of a crime, or (4) an act or omission which in the soleCompany and Independent contractor agree as follows 1 The Company hereby employs the independent contractor as an independent contractor, and the Independent contractor hereby accepts employment 2 The term of this Agreement shall commence on _____ After the first thirty

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

10 Free Independent Contractor Agreement Templates Printable Samples

Independent Contractor Agreement Pdf Templates Jotform

Independent Contractor Agreement Template 3 Pdfsimpli

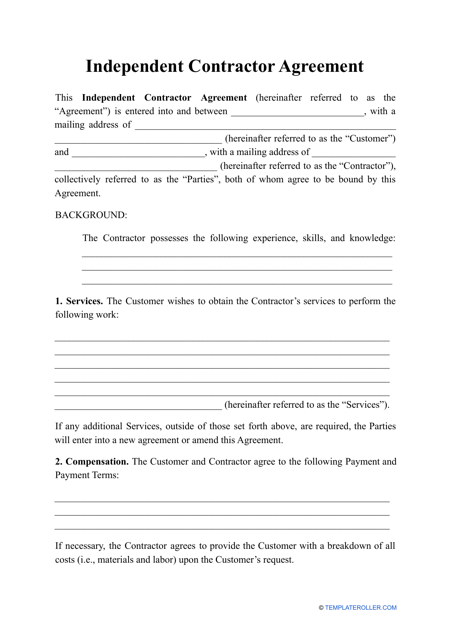

Independent Contractor Agreement Template Download Printable Pdf Templateroller

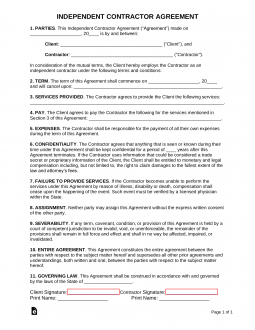

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

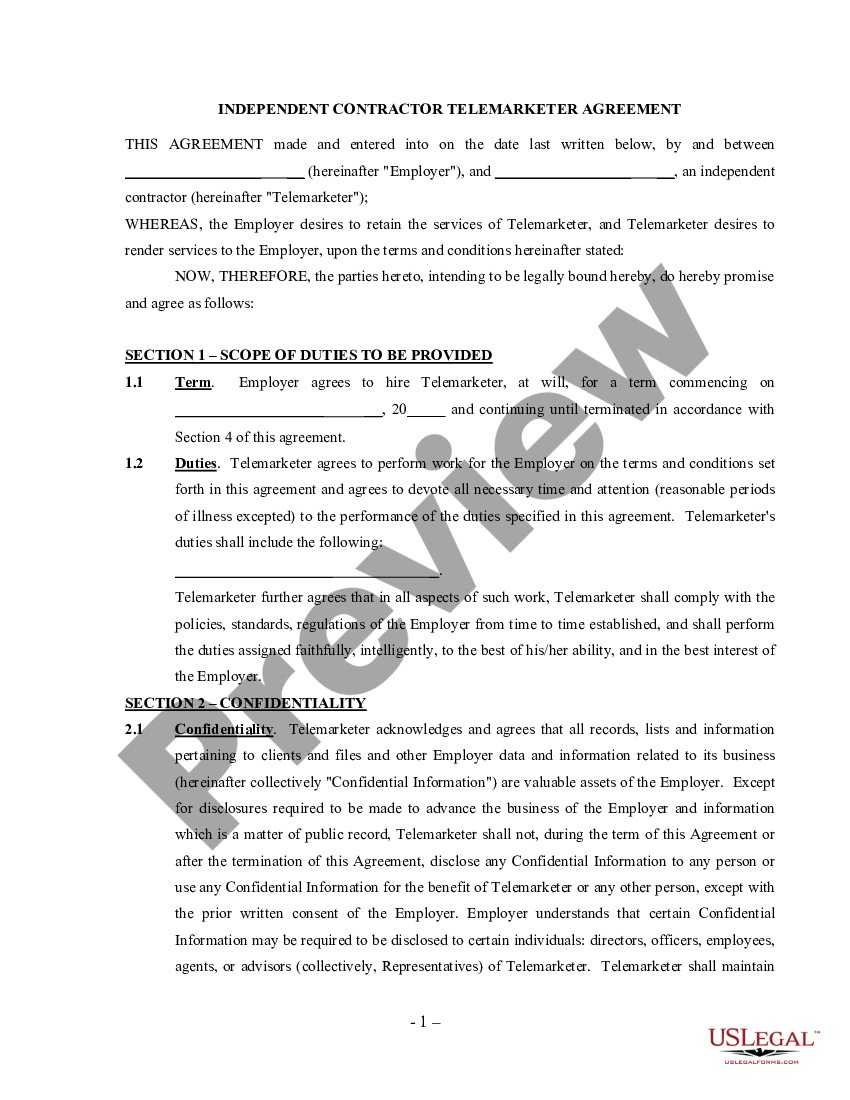

Telemarketing Agreement Self Telemarketing Agreement Sample Us Legal Forms

18 Contractor Agreement Examples Pdf Word Docs Examples

Independent Contractor Agreement Template Contract Agreement Contractor Contract Nomad Legal

Independent Contractor Agreement Sample In Word And Pdf Formats

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Agreement Between Owner And Contractor Template Sample Form Contractor Contract S Contractor Contract Separation Agreement Template Contract Template

Independent Contractor Contract Template The Contract Shop

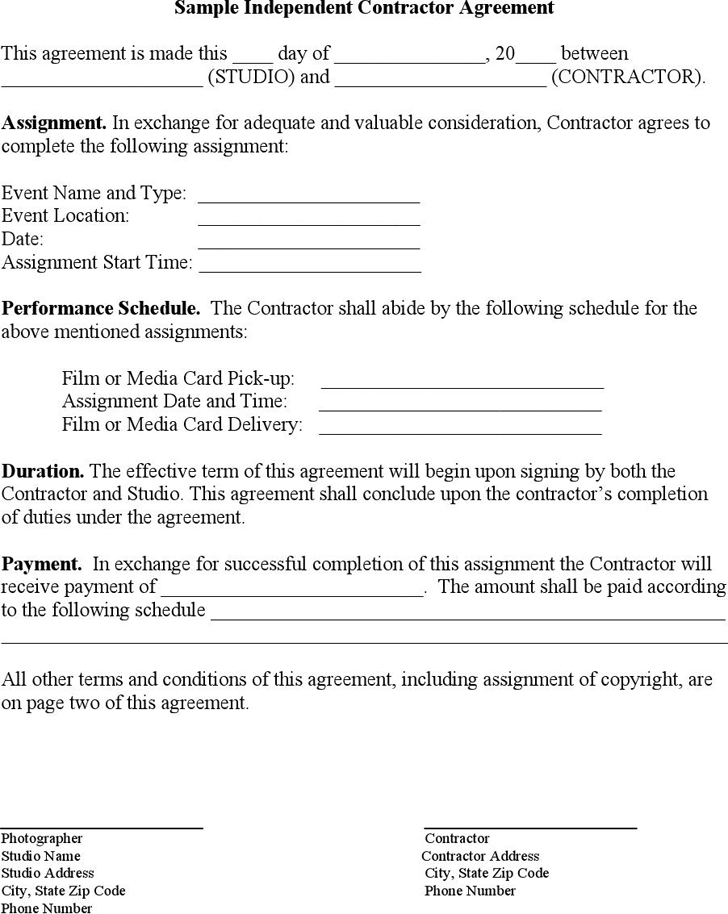

Sample Independent Contractor Agreement

3

42 Simple Independent Contractor Agreement Template Free To Edit Download Print Cocodoc

Independent Contractor Agreement Template My Word Templates

Independent Contractor Agreement Template Free Pdf Sample Formswift

Free 10 Sample Independent Contractor Agreement Forms In Ms Word Pdf Excel

Free Sample Independent Contractor Agreement Pdf 11kb 2 Page S

Independent Contractor Agreement Programming Modele Professionnel

Free Florida Independent Contractor Agreement Pdf Word

An Overview Of A Simple Independent Contractor Agreement I Am Landlord

Contract Templates And Agreements With Free Samples Signwell Formerly Docsketch

Fillable Independent Contractor Agreement Template Printable Pdf Download

Free Independent Contractor Agreement For Download

Independent Contractor Commission Agreement Online Business Templates At Allbusinesstemplates Com

50 Free Independent Contractor Agreement Forms Templates

Free California Independent Contractor Agreement Word Pdf Eforms

Independent Contractor Agreement Etsy

Independent Contractor Agreement Creative Contracts

50 Free Independent Contractor Agreement Forms Templates

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Exclusive Contractor Agreement Template By Business In A Box

Truck Driver Independent Contractor Agreement New Truck Driver Contract Agreement Template 21 Awesome Trucking Pany Models Form Ideas

Http Www Atri Org Articles Independent contractor agreement Pdf

Independent Contractor Agreement

Logo Your Compliance Edge Toggle Navigation Employee Benefits Benefits Notices Calendar Benefits Notices By Company Size Cafeteria Plans Cobra Dental Insurance Dol Audits Educational Assistance Employee Assistance Programs Eaps Erisa

Ne0274 Real Estate Consultant Independent Contractor Agreement Template English Namozaj

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Free Independent Contractor Agreement Template What To Avoid

Free Independent Contractor Agreement Free To Print Save Download

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Free Printable Independent Contractor Agreement Form Contractor Contract Construction Contract Contract Template

Free Independent Contractor Agreement For Download

Independent Contractor Contract Template Awb Firm

Independent Contractor Agreement Agreement For Consulting Services

Free 7 Sample Independent Contractor Agreement Forms In Pdf Ms Word

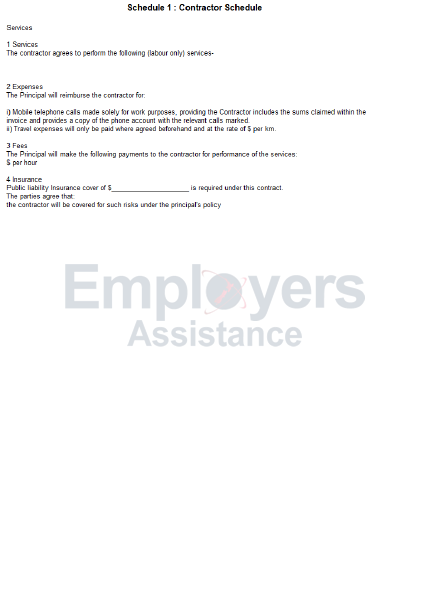

Independent Contractor Agreement Guide Employers Assistance

Free Independent Contractor Agreement Templates Word Pdf

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Sample Consulting Contract

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Free Independent Contractor Agreement For Download

Independent Contractor Agreement Guide Employers Assistance

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Use A Nda With Independent Contractor Agreements Everynda

How To Insert Smartfields Into Your Contracts Signature Electronique

Independent Contractor Agreement Full Time

Independent Contractor Agreement 16 Free Pdf Google Docs Apple Pages Format Free Premium Templates

Independent Sole Trader Contractor Agreement

Create An Independent Contractor Agreement Download Print Pdf Word

Ne00 Independent Contractor Agreement Template English Namozaj

1099 Contract Employee Agreement

Independent Contractor Agreement Template Download It Here

1

3

Independent Contractor Agreement Contractor Agreement Contract Contractor Contract Sample Contractor Contract Contract Contractors

Www Legalzoom Com Download Pdf Independent Contractor Agreement Pdf

Independent Contractor Agreement Pdf Template Kdanmobile

Contractor Agreement Individual Free Template Sample Lawpath

Independent Contractor Agreement Legalforms Org

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Agreement Template Contract The Legal Paige

0 件のコメント:

コメントを投稿